India Post Payments Bank

India post payments bank: I am crossing the post office there Outside the post office, some of the postmen are only giving information about IPPB. I heard that the Indian payment bank for the first time talks about the advantage of IPPB. The Post Department of the Ministry of Communications, India Post Payments Bank (IPPB) is a government 100% owned by the government of India

The India Post Payments Bank (IPPB) service has started across the country. IPPB is providing a wide range of services to its customers at home. For example, you will obtain the balance or mini account statement (information from the last ten transactions) in the account that is in your IPPB home. Let us know about other features of IPPB.

सरकारी नौकरी और सरकारी योजना की जानकारी सबसे पहले पाने के लिए हमसे जुड़े IPPB also provides intrabank funds transfer services to its clients. The current money transfer facility is also available to you. India Post Payments Bank (IPPB) to transfer funds through NEFT, RTGS, IMPS.

NEFT (Electronic National Funds Transfer), RTGS (Real Time Gross Settlement) and IMPS (Immediate Payment Service) are payment platforms that allow instant money transfer from your bank account to another person’s bank account.

india Post Payments Bank Offer Doorsteps Banking

Indian post bank Gives Banking facilities at our Home with doorsteps banking. you can do your all banking work on your home like Banking transaction, cash withdraw, also open your account at your home .indian post use their network of postman across in India

Postman is handled all banking work on your doorsteps Benefits of Indian post payment bank Doopsteps banking

Benefits of Indian post payment bank Doopsteps banking

- easy and convenient banking

- simple secure and hassle-free banking work

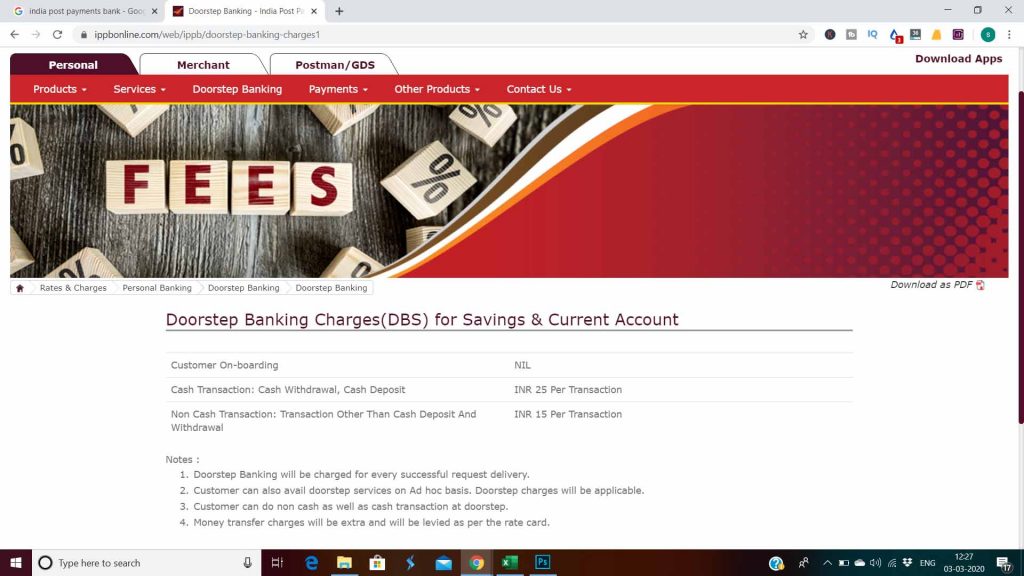

Doorsteps Banking Charge

How much is the charge?

India Post Payments Bank (IPPB) charges up to Rs 2.5-25 for the amount transferred to another bank account through NEFT. If you do NEFT with IPPB mobile banking, then you will be charged up to Rs 2.5-20.

According to the information provided by India Post Payment Bank (IPPB), if you transfer funds from your account through RTGS, you must pay a fee between Rs 25-50.

If you transfer funds through the IPPB IMPS service, you must pay a fee of Rs 5-50.

If you want to take advantage of the IPPB home banking installation (home banking), then you should understand these things for this.

Transactions are free for customers onboard in IPPB. If you wish to make any transaction in cash taking advantage of the IPPB home banking service, you must pay a fee.

You can click on this link to get more information about the bank charge of the Bank of Indian Post Payments (IPPB)

India Post Payments Bank Saving Account

There are 3 type of Saving Account

- Digital Saving Account

- Regular Saving Account

- Basic Saving Account

Digital Saving Account is the best for Mobile banking .who comfortable use to technology, this best for digital uses. you can download an app from play store for android user & also available for i Phone user on apps store

India Post Payments Bank Offer Services

- MOBILE BANKING

- SMS BANKING

- MISSED CALL BANKING

- PHONE BANKING